RE/MAX NATIONAL HOUSING REPORT Q2 2019

Signs of an Increasingly Active Property Market

The overall sentiment of current market conditions is, well, slow at best. However, the data for the second quarter of 2019 provides the first glimmers of hope for a property market that is becoming increasingly active.

According to Lightstone Property data, a total of 45,109 bond registrations were recorded at the Deeds Office over the period of April – June 2019, totalling an amount of R49,452,070,000. This translates into a 13.2% increase in the amount of bonds registered since Q1 2019 and an 18.5% increase since Q2 2018. The number of transfers (both bonded and unbonded) recorded at the Deeds Office between April and June also increased by 6% from last year, and by 14% from Q1 to 65,394 transfers in the second quarter of 2019.

“While it is normal for the second quarter of the year to record more transactions than the first quarter, it is encouraging to see that there is also sturdy year-on-year growth. I therefore remain hopeful that the property market will become increasingly active, provided that the newly elected government provides political stability and effectively manages our economic growth as the year progresses,” says Adrian Goslett, Regional Director and CEO of RE/MAX of Southern Africa.

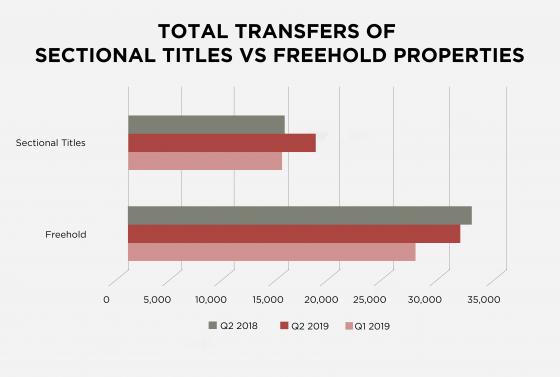

Higher Price Growth & Lower Sales Volumes for Freehold Titles

Of the 65,394 transfers, a total of 31,098 freehold properties and 17,034 sectional title units were sold countrywide (*these figures exclude estates, farms, and land only transfers). “When compared to the first quarter of 2019, these figures translate into a 12.2% increase in the number of freehold properties sold. However, when compared to the figures in Q2 2018, the second quarter of 2019 experienced a 4.2% decrease YoY. Sectional titles, on the other hand, saw an 18.4% increase in the number of sales when compared to the sales figures of Q1 2019, and an 18% increase when compared to the sales figures of Q2 2018. These figures reflect the rising popularity of sectional title living and the increasing supply of these sorts of homes on the market,” Goslett explains.

However, when it comes to house price growth, freehold titles still have the edge over sectional titles. According to Lightstone data, the current national median price of a freehold home has grown to R1,148,167 which is a 14.3% increase on the median asking price for Q2 2018 (R1,004,733). In comparison, the national median price of a sectional title grew by just 2.1% to R1,032,045 from the R1,010,752 in Q2 2018. The average active RE/MAX listing price for this period increased by 2.7% from Q2 2018 and amounted to R2,809,728.37.

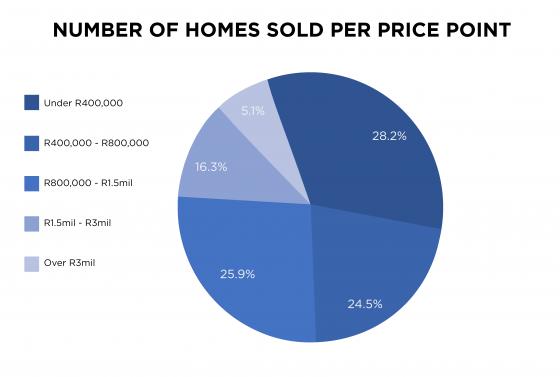

Shifts in the Affordability Scale

In the second quarter of 2019, 28.2% of transfers fell within the R0 – R400,000 price range; 24.5% were priced between R400,000 and R800,000; 25.9% were between R800,000 and R1,5 million; 16.3% were between R1,5 million to R3 million; and, transactions over R3 million accounted for 5.1% of all bond registrations for the fourth quarter. Excluding the R0 - R400,000 price bracket, the amount of homes sold within the other price brackets grew by 11.6%; 18.3%; 19.2%; and 9.7% YoY respectively. However, the amount of homes sold within the R0 - R400,000 price bracket decreased by 12.4% YoY.

“These figures point to national house price growth whereby fewer and fewer homes are available for below R400,000. This escalation of price is reflected in the growth in the average bond amount granted during this period, with a 2.2% increase on the figure for Q2 2018 to R1,096,000 in the second quarter of 2019,” says Goslett.

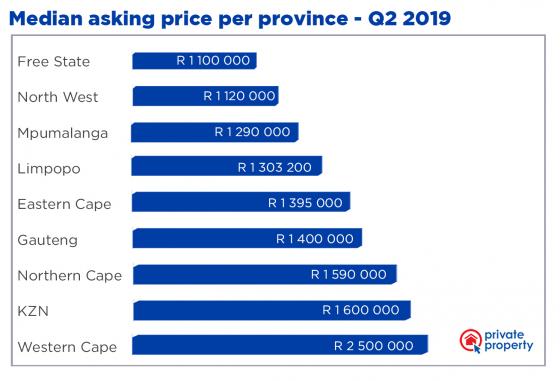

Province Performance Breakdown

When it comes to a provincial breakdown of the property market, Gauteng dominated the Top 5 searched suburbs nationally on remax.co.za during Q2 2019, with only one suburb outside of this province claiming a spot on this list. Glen Marais in Gauteng placed first, followed by Parklands in the Western Cape, then Moreletepark in Gauteng, and lastly Bryanston and Morningside in Gauteng.

According to Private Property statistics, the Western Cape still has the highest national median asking price at R2,500,000 and the Free state has the lowest at R1,100,000. However, the Western Cape saw a 2% drop in median asking price compared to the first quarter of 2019, whereas Gauteng remained the same as last quarter’s figures. Overall, the Northern Cape reflected the highest quarter-on-quarter growth, with the median asking price increasing by 4% on last quarter to R1,590,000. The Free State came in second with 3% growth on last quarter’s amount. Conversely, Limpopo reflected the largest drop in median asking price with a 3.5% decrease on last quarter’s figures to R1,303,200.

“Overall, RE/MAX continues to do well across the country despite the challenging market. Year to date, our network has concluded close on R10 billion in registered sales. I am incredibly proud of our RE/MAX affiliates and wish them continued success as we enter the third quarter of 2019,” Goslett concludes.

For more information, get in touch with a trusted real estate advisor from the largest real estate brand in Southern Africa, visit www.remax.co.za.

Send to a Friend